Market Business Insights has added the latest report on the global Asset Liability Management (ALM) market to its collection of market research reports that provide a complete overview of the respective market. This report researches and evaluates the impact of the Covid-19 outbreak on the Asset Liability Management (ALM) industry by involving the potential opportunity & challenges, drivers, and risks.

The research report on the global Asset Liability Management (ALM) market represents a detailed analysis of the market growth stimulators and restraints that have a huge contribution to the overall market growth. Furthermore, the market orientations are mentioned using specific market research methodologies.

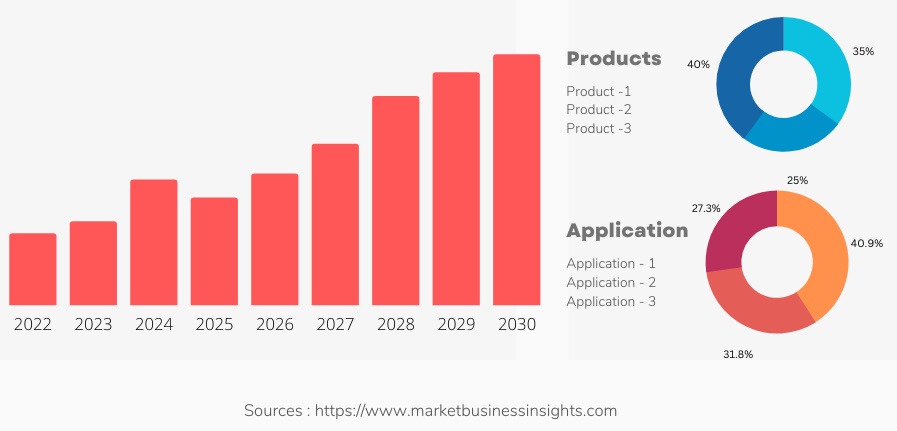

The global Asset Liability Management (ALM) market is expected to grow approximately to USD XX million from 2022 to USD XX million by 2030, at a CAGR of XX during the forecast period 2022 - 2030.

The research report also provides details regarding the achievements made by the key players in the global Asset Liability Management (ALM) market. The competitive landscape section is projected to deliver crucial data such as the business policies or strategies, latest development trends, and revenue that are lucrative for the market growth rate.

The prominent market players include:

Report Objectives:

The Asset Liability Management (ALM) research report majorly provides a complete and unbiased outlook of the market. Also, to gain more knowledge over the Asset Liability Management (ALM) market, the report provides all the macroscopic and microscopic details through each segment and figurative and tabular representations.

In conclusion, the accurate and evaluated details regarding the global Asset Liability Management (ALM) market have been put together using specific research methodologies. Furthermore, experts have authenticated the report to provide the most accurate and exhaustive market report to the readers.

The global Asset Liability Management (ALM) market size, revenue, and other financial information are provided by regions and competitive players. The regional development status provides a complete view of the product demand, consumption rate, and future market scope. The political and socio-economic status of the regions is expected to have an impact on the market dynamic.

| Companies Covered |

Above list is not exhaustive, you can add required companies. |

|---|---|

| Segments Covered |

Segment can be customized. You can ask for customization. |

| Purchase Option | Avail of customized purchase options to meet your exact research needs. Explore purchase options |